Relay Review: The Best Business Bank Account for Profit First

Relay is a business bank account built for the Profit First method with multiple free checking accounts and auto-transfers. This review tests budgeting flow, team access, and integrations. Covers real use and whether Relay beats traditional banks for small business finances.

Relay

Relay is a business banking platform built on real FDIC-insured banking infrastructure that makes it easy to manage multiple sub-accounts and automate the Profit First accounting method.

Small business owners, freelancers, and entrepreneurs who want a modern business bank account with built-in tools for financial organization and Profit First budgeting.

Capital One Spark, Mercury, Novo, traditional bank accounts

The Three Financial Tools Every Business Needs

Tax season has a way of reminding business owners just how important their financial infrastructure really is. Whether you're a brand-new entrepreneur or someone who's been at it for years, getting your financial tooling right can mean the difference between a stressful April and a completely painless one.

After running a six-figure agency for years, I've narrowed it down to three essential financial tools every business should have in place. First, you need a solid accounting tool. In the US, your realistic options are QuickBooks Online or Xero, and having used both extensively, Xero is the clear winner in my book. Second, you need a proper payroll system — Gusto is hands-down the best I've used in over 20 years. And third, you need a dedicated business bank account, which is where Relay comes in and steals the show.

The biggest mistake new entrepreneurs make is treating client payments like a personal paycheck. Setting up a proper business bank account from day one separates your business finances from your personal ones and sets you up for a much smoother tax experience down the road.

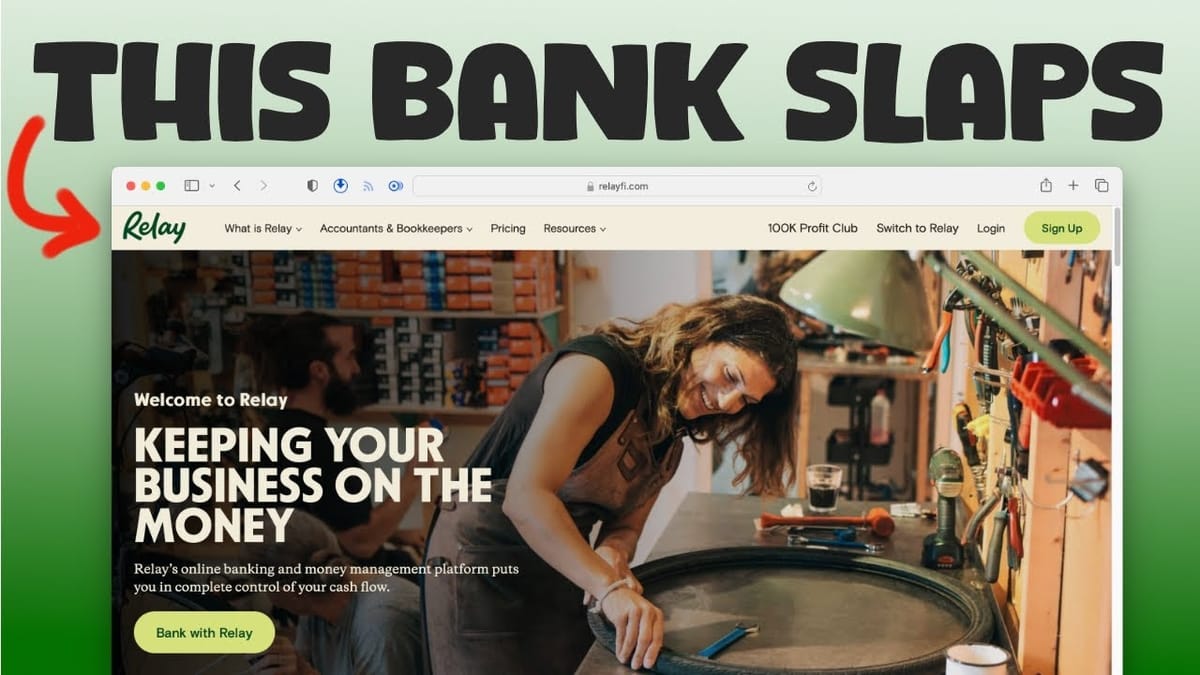

What Is Relay and Why Isn't It a Bank?

When you first log into Relay, it looks and feels like a bank account. But Relay is technically a financial technology company, not a bank — and that distinction matters more than you'd think. Traditional banks don't exactly have a reputation for loving technology. Relay does, and it shows in every corner of the product.

Relay partners with Thread Bank under the hood, so your deposits are fully FDIC insured. You get all the security of a real bank with the user experience of a modern software company. This is the same model several fintech companies have adopted, but Relay executes it better than any alternative I've tried.

The reason Relay stands out from the crowd is its deep integration with the Profit First methodology — a popular accounting framework designed for non-accountants. If you've never heard of Profit First, it's a system from a bestselling book that came out about ten years ago. It fundamentally changes how you think about business income and expenses, and Relay was essentially built around it.

Setting Up Profit First Inside Relay

The Profit First system works by splitting your business revenue into multiple dedicated accounts: income, owner's pay, operating expenses, profit, and taxes. Income, owner's pay, and operating expenses are checking accounts, while profit and taxes are savings accounts. The idea is simple — every dollar that comes into your business gets allocated to a specific purpose so you always know exactly where you stand.

Try setting this up at a traditional bank and you'll quickly run into friction. You'd need to make an appointment, sit down with a banker, and explain why you need five sub-accounts. If you're a new business without a massive balance, you might get turned down entirely. With Relay, adding a new checking or savings account takes a few clicks. No appointments, no awkward conversations, no minimums.

Once your accounts are set up, you need to determine your target allocation percentages — how much of your income goes to each bucket. The Profit First book walks through this in detail, and there are free calculators online (search for "TAP calculator Profit First") that make it straightforward. After that, all your business revenue flows into the income account first, giving you a real-time snapshot of how your business is performing on any given day.

The traditional Profit First approach says you should log in on the 10th and 25th of each month and manually distribute funds from your income account to the others. Before Relay, I was doing this with a Google Sheet and manual bank transfers — it worked, but it was tedious. Relay completely automates this with auto transfer rules. You can set up a Profit First rule that keeps a base amount in income and distributes the rest according to your percentages on a weekly or bi-weekly schedule. The entire allocation process that used to take me 20 minutes now happens automatically every Monday.

Other Features That Make Relay Worth It

Beyond Profit First automation, Relay has several features that set it apart from traditional business banking. Virtual debit cards are available instantly when you create a new account — no waiting for a card in the mail. You get a full card number that works anywhere Visa is accepted, which is perfect for online purchases. Physical cards are also available if you need them.

The built-in receipt scanner is another standout feature. You can scan receipts directly in the app, send them via SMS or email, and Relay auto-matches them to the corresponding transactions based on the amounts. No manual sorting or categorizing required. For anyone who's ever dreaded organizing a shoebox of receipts at tax time, this alone is worth the switch.

Team management is handled thoughtfully as well. You can add team members with granular permission levels, similar to how you'd manage roles on a website. This extends to financial advisors too — if you work with a CPA, you can give them direct access to your Relay account without sharing login credentials. Relay also integrates directly with both Xero and Gusto, which means your entire financial stack can talk to each other seamlessly. And if you run multiple businesses, you can manage them all from a single Relay login.

Everything I've described is available on Relay's free plan. I've personally never paid a dime. They do offer Relay Pro at $30 per month, which adds bill auto-importing from Xero or QuickBooks, a centralized bill management hub, and multi-stage approval workflows for larger teams. For most small businesses, the free tier is more than enough to get started.

Watch the Full Video

Prefer watching to reading? Check out the full video on YouTube for a complete walkthrough with live demos and commentary.

Final Verdict

Relay is the best business bank account for entrepreneurs using the Profit First method. The multiple checking accounts with no fees, automatic profit allocations, and clean dashboard solve real problems that traditional banks ignore.

The lack of cash deposits and limited international features may be dealbreakers for some businesses. But for online businesses and service providers who operate digitally, Relay delivers exactly what Profit First practitioners need without the monthly fees.

Rating: 8.5 out of 10

Frequently Asked Questions

What is Relay Financial?

Relay is a business banking platform designed for small businesses and entrepreneurs. It offers free business checking accounts with features built around the Profit First money management method.

Does Relay support the Profit First method?

Yes, Relay is one of the few banks that natively supports Profit First by letting you create up to 20 checking accounts for free to allocate funds into different categories like profit, taxes, and operating expenses.

Is Relay a real bank?

Relay is a fintech platform that partners with Thread Bank, an FDIC-insured bank. Your deposits are federally insured up to $250,000, providing the same protections as a traditional bank.

Does Relay charge monthly fees?

Relay offers free business checking with no monthly fees, no minimum balance requirements, and no transaction fees. Revenue comes from premium features and interchange fees on the debit card.

Can Relay replace a traditional business bank?

For most small businesses, Relay can fully replace a traditional bank. It offers ACH transfers, wire transfers, bill pay, and integrations with accounting software like QuickBooks and Xero.